If your return is not accepted before the application closes, print and mail it. Your return has not been filed until you receive an email saying your return was accepted by the IRS. If you receive an email saying your return was rejected, you must correct any errors and resubmit your return before October 20, 2023.Īfter you submit your return, you will receive an email from verifying the IRS accepted your federal return. You will not be able to access your account to e-File, print or review your return information.

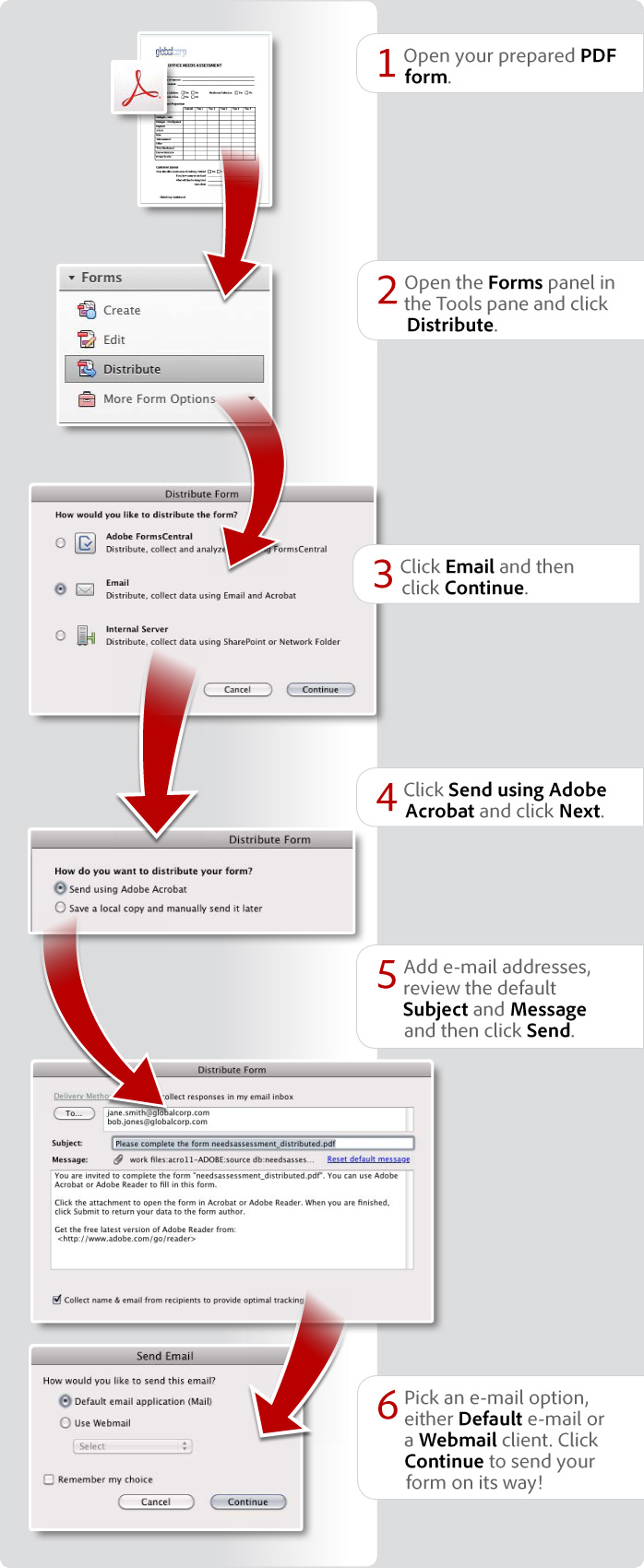

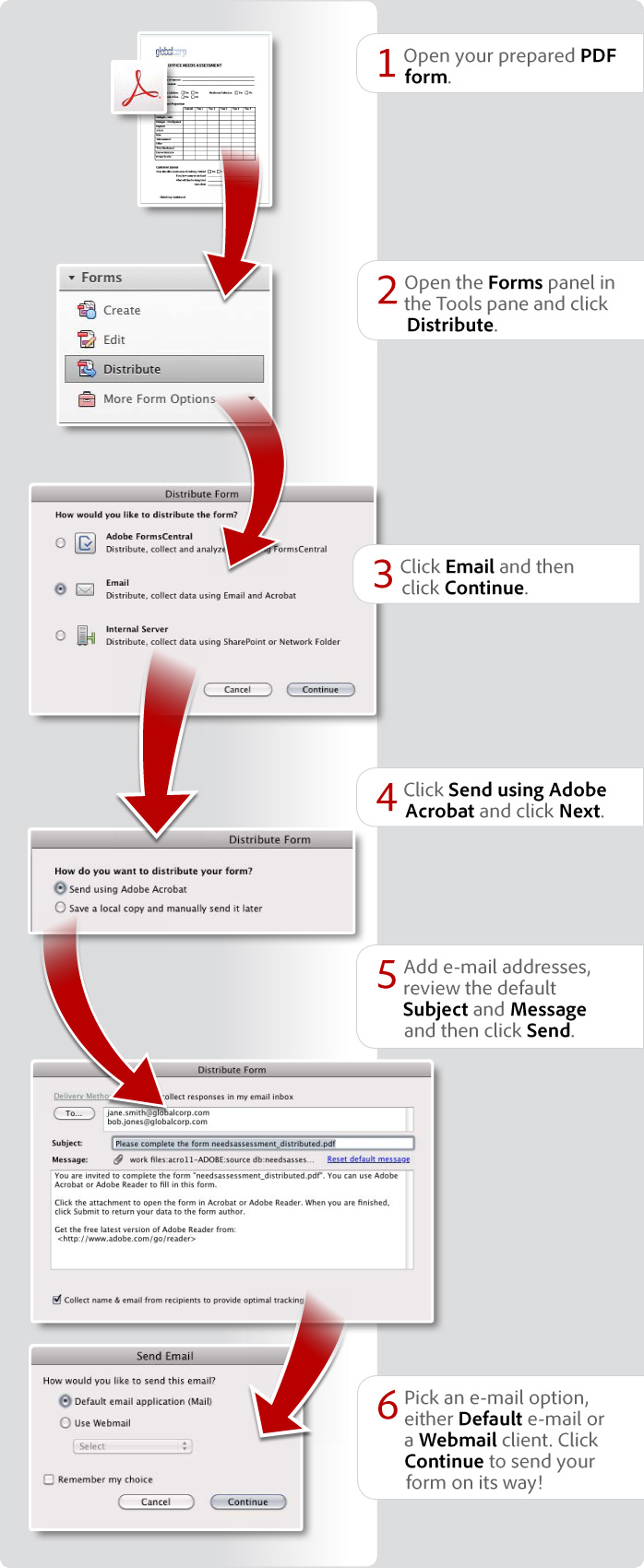

When Free File Fillable Forms closes after October 20, 2023, your account is deleted from the server. This application and customer support is limited to English. View the International Filers page if you have a foreign or military address.  Use the Line-by-Line Instructions while working with your forms. You will find three variants a drawn, typed or uploaded eSignature. Decide on what type of eSignature to generate. Review the forms and limitations page for the list of supported forms/schedules Stick to the step-by-step instructions listed below to electronically sign your fillable calendar: Find the form you want to sign and click on the Upload button. Using a Recommended Browser will help avoid common browser issues. Open the User's Guide PDF for a reference while navigating through the application.

Use the Line-by-Line Instructions while working with your forms. You will find three variants a drawn, typed or uploaded eSignature. Decide on what type of eSignature to generate. Review the forms and limitations page for the list of supported forms/schedules Stick to the step-by-step instructions listed below to electronically sign your fillable calendar: Find the form you want to sign and click on the Upload button. Using a Recommended Browser will help avoid common browser issues. Open the User's Guide PDF for a reference while navigating through the application.  Help contains links to information you may need. October 21 is the last day you may access your account.

Help contains links to information you may need. October 21 is the last day you may access your account.

For Tax Year 2022 this tax filing application operates until October 16, 2023.įrom October 17 through October 21, you may access your account, resubmit a rejected return and a print return.

0 kommentar(er)

0 kommentar(er)